For years, centralized exchanges (CEXs) were the undisputed kings of the crypto world. Binance, Coinbase, Kraken, KuCoin—these giants shaped liquidity, attracted millions of traders, and dictated market structure. But over the last 24 months, an undeniable shift has emerged.

A new wave is rising.

A quieter, more powerful force.

A force built not on corporate control but on code, community, and self-custody.

Decentralized exchanges (DEXs).

Once dismissed as clunky, slow, or niche products, DEXs have evolved into sophisticated trading ecosystems. They now attract billions in liquidity, rival CEX volumes, and offer something centralized platforms never could:

True ownership and trustless trading.

The question that now looms is no longer if DEXs matter—it’s whether they might eventually replace centralized exchanges outright.

Let’s dive deep into what’s driving DEX dominance—and whether CEXs are living on borrowed time.

The Rise of DEXs: A Shift From Dependence to Autonomy

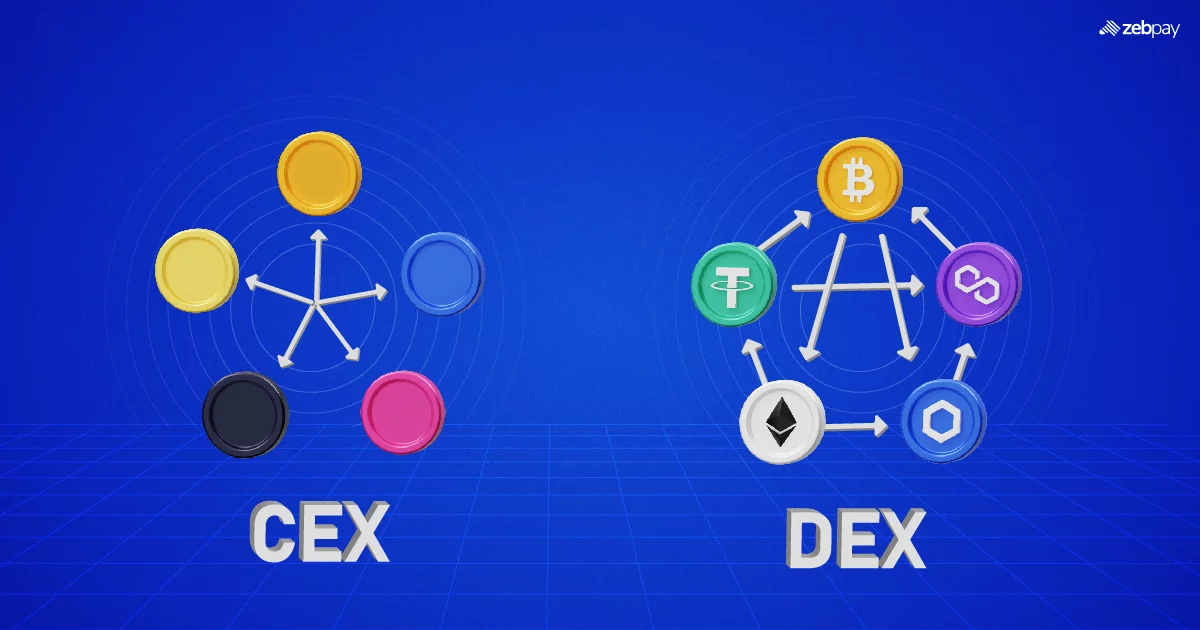

Crypto was founded on decentralization, yet most users flocked to centralized exchanges because of convenience. Markets needed order books, liquidity, and user-friendly interfaces. CEXs stepped in, filled the gap, and built empires.

But the cracks in the system became impossible to ignore:

- collapses of major exchanges

- frozen withdrawals

- mismanaged funds

- opaque accounting

- regulatory overreach

- loss of user custody

Every time a CEX failed, the core message of crypto—“not your keys, not your coins”—glared brighter.

DEXs, meanwhile, evolved at lightning speed:

- faster trading

- deeper liquidity

- cheaper fees

- safer custody

- permissionless access

Suddenly, the decentralized model wasn’t just ideological—it was practical.

What DEXs Offer That CEXs Never Can

To understand DEX dominance, you must understand what makes them fundamentally superior to centralized systems in key areas.

1. Self-Custody: Control Without Compromise

CEXs ask for blind trust.

DEXs eliminate trust entirely.

On a DEX:

- You own your private keys

- Your funds stay in your wallet until the trade

- No middleman can freeze, seize, or misuse your assets

In a world where exchange collapses have caused billions in losses, self-custody becomes a superpower.

2. Transparency You Can Verify

Centralized exchanges are black boxes.

DEXs are glass boxes.

Every transaction, liquidity pool, fee, and smart contract is:

- visible

- auditable

- immutable

Trust isn’t required when everything is verifiable.

3. Global, Permissionless Access

CEXs can restrict you.

DEXs can’t.

On decentralized platforms:

- No KYC

- No region blocks

- No banking intermediaries

- No gatekeepers

If you have an internet connection and a wallet, you’re in.

That is powerful.

4. 24/7 Markets Without Downtime

CEXs can go offline.

DEXs rarely do, thanks to decentralized infrastructure.

As long as the underlying blockchain is alive, the exchange is alive.

No outages.

No “trading halted.”

No “systems under maintenance.”

Just continuous, global liquidity.

Why DEXs Have Exploded in the Last Two Years

The tipping point for decentralized exchanges was not just ideological—it was technological.

1. Better AMMs and Liquidity Models

Automated market makers (AMMs) evolved from simple constant-product pools to:

- concentrated liquidity

- hybrid AMM/order book systems

- dynamic fee models

- on-chain market makers

Uniswap v4, Curve v2, PancakeSwap v3—these upgrades unlocked CEX-level trading efficiency.

2. Layer-2 Scaling Has Been a Game-Changer

High gas fees once crippled DEX adoption.

Now, with:

- Arbitrum

- Optimism

- zkSync

- Base

- Starknet

DEXs operate:

- faster

- cheaper

- smoother

The decentralized experience finally feels like Web2—only better.

3. Institutional Attention Shifted the Narrative

Wall Street doesn’t want more CEX scandals.

They want:

- transparency

- compliance-friendly rails

- programmable assets

- real-time settlement

DEXs (and their hybrid variants) are becoming the future infrastructure of institutional finance.

So… Will DEXs Kill CEXs?

The short answer: No, but they will dominate core functions.

The long answer: DEXs will redefine the trading landscape while CEXs reinvent themselves to survive.

Here’s how the next decade will likely unfold:

What DEXs Will Dominate

1. Asset custody

People will no longer tolerate custodial risk.

Self-custody will become the norm.

2. Token listings

DEXs already list thousands of tokens instantly—no approvals, no politics.

3. Global retail access

Decentralized, permissionless markets are unstoppable.

4. Liquidity provision

Traditionally controlled by institutions, liquidity is now democratized via LP tokens and yield incentives.

DEXs will excel in these areas so convincingly that CEXs cannot compete.

Where CEXs Will Still Matter

CEXs won’t disappear entirely—at least not soon. They will remain dominant in:

1. Fiat On-Ramps

You still need a bank or card to enter crypto—CEXs make this seamless.

2. Compliance-Heavy Regions

Regulators prefer centralized gatekeepers for oversight.

3. Large institutional block trades

Off-chain settlement is often faster for multi-million-dollar orders.

4. Advanced derivatives and leverage markets

CEX infrastructure currently handles complex financial instruments better.

The Final Evolution: Hybrid Exchanges

The future might not be CEX vs. DEX.

It might be CEX + DEX = Hybrid.

We’re already seeing exchanges blend:

- decentralized custody

- on-chain settlement

- centralized liquidity

- regulatory compliance

- transparent smart contracts

- off-chain matching engines

Hybrid models could offer:

- CEX speed

- DEX transparency

- CEX liquidity

- DEX user ownership

This is likely the ultimate industry equilibrium.

The Verdict: DEXs Won the Philosophy Battle—Now They’re Winning the Market

Decentralized exchanges represent:

- the soul of crypto

- the next evolution of trading

- the infrastructure for DeFi

- the backbone of Web3

- the inevitable migration away from custodial risk

Will DEXs replace CEXs entirely?

Not tomorrow.

Not next year.

But the trend is clear, unshakeable, and accelerating:

CEXs are being forced to evolve.

DEXs are being positioned to dominate.

The future of trading is trustless, transparent, and decentralized—whether the giants like it or not.

And this shift isn’t a possibility.

It’s already happening.